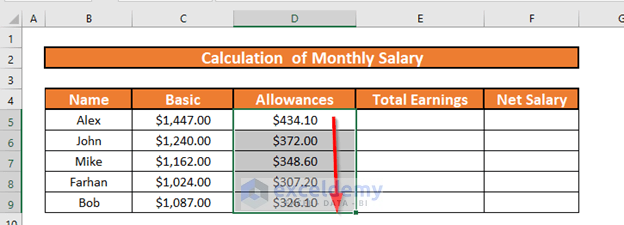

How Do You Calculate Them. Input the Basic Salary Allowances Deductions and Overtime to calculate the gross salary.

Area Of Circle Triangle Square Rectangle Parallelogram Trapezium Ellipse And Sector

RM 5500 x 11 refer Third Schedule.

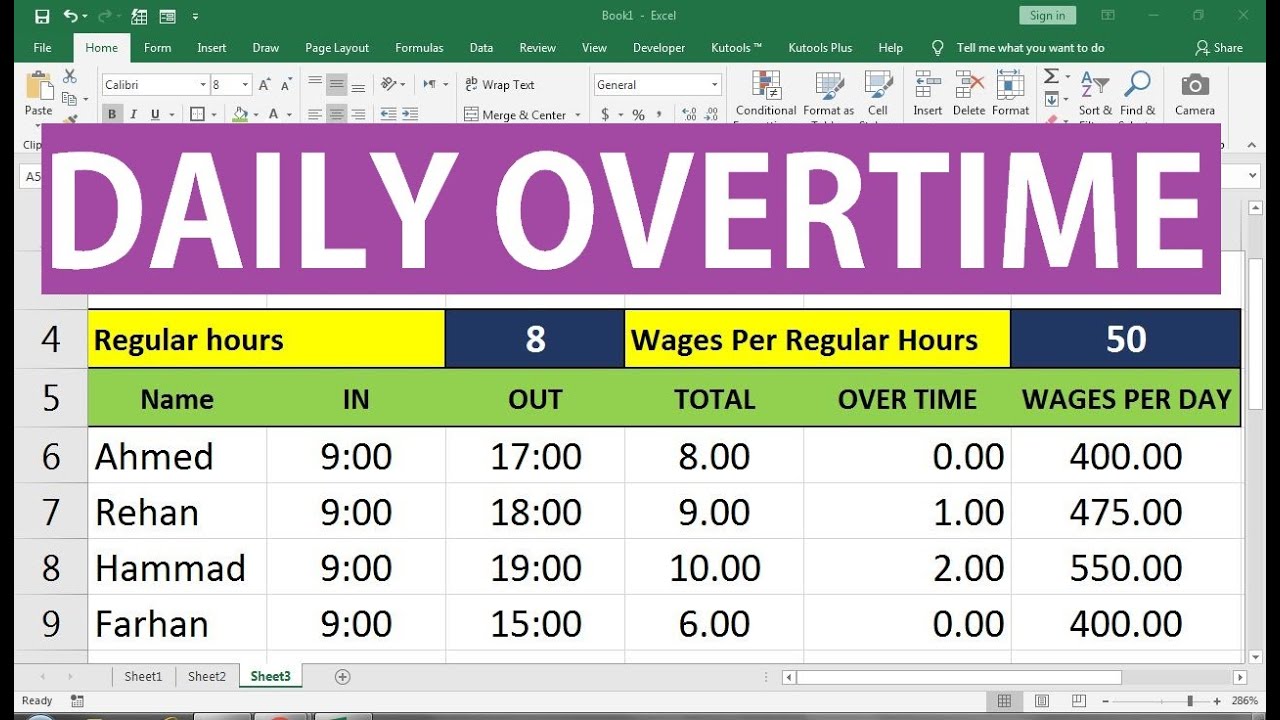

. 1 hour rate x OT rate x hours worked OT amount. Rm50 8 hours rm625. The employees share of the EPF statutory contribution rate was reduced from 11 per cent to 9 per cent in 2021 affecting wages for the months of January to December 2021.

Enter your basic monthly salary monthly bonus select your EPF percentage contribution and enable EIS and PBC. Here this would be RM625 x 15 x 2 hours RM1875. A gross calculation based on the formula done by the United Nations UN showed that up to last year Chias recycling company which was established in 2018 had helped reduced over.

Originally published on November 19 2021 by Julie Employers are required to pay 10 days of wages per year for employees who have been employed for less than two years. Tax rates range from 0 to 30. SalaryOT working days in a monthstandard working hours 1 hour rate.

Salarycal Salary Calculator Malaysia. The quickest way to get your take-home pay. Employees who earn monthly wages of RM2000 or less.

RM50 8 hours RM625. This salary calculator is applicable for monthly wages up to RM20000 and shows estimates only. Working period of 2- 5 years 15 days salary per year.

Its free to sign up and bid on jobs. Salary with fixed allowances X 12 months X years of services divided by 365 days. Then calculate the overtime pay rate by multiplying the hourly rate by 15 and then multiply that figure with the number of overtime hours worked.

Working Hours Wages Malaysia Subject Formula Example Ordinary rate of pay daily pay Monthly pay eg minimum wage number of working days ordinary rate of pay RM1000 26 days RM 3846 Hourly rate pay Daily pay normal hours of work hourly rate pay RM 3846 8 hours RM 480 Overtime work during normal day 15 x hourly rate. Working period of 1- 2 years 10 days salary per year. However the Act only covers a number of select employee categories in Malaysia.

Divide the employees daily salary by the number of normal working hours per day. Working hours permitted under akta kerja 1955. Layoff Benefits in Malaysia.

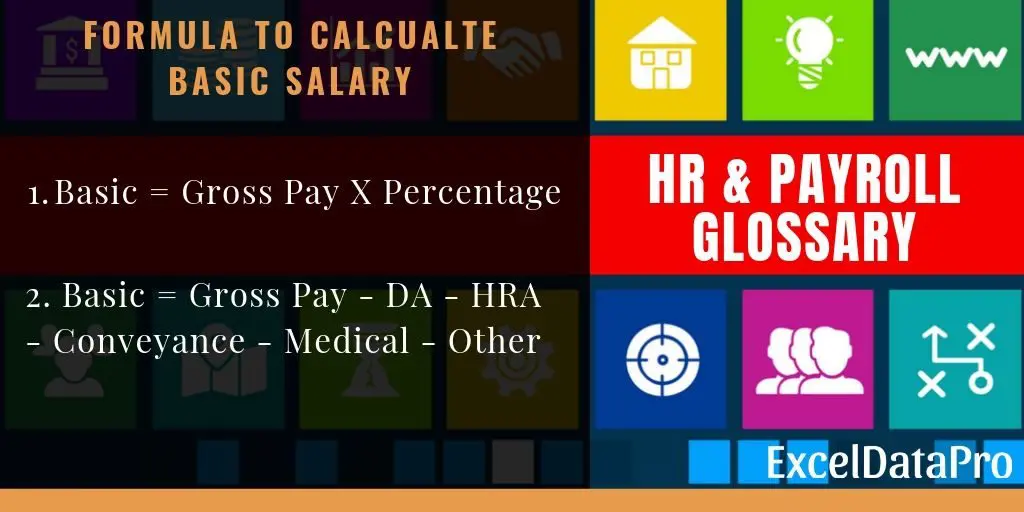

A The formula for calculating OT amount in our system. Salary Formula as follows. For exceeding amounts there is a calculation formula that you can find in the public ruling for this allowance.

Salarycal is a useful Android device app that lets you compute your salary by also deducting your other monthly expenses such as loans and credit card bills. Employee Starts work on 1212016 his salary is RM 1000. The PCB calculator 2021 in Actpay is approved by LHDN Malaysia and has 100 calculation accuracy verified repeatedly over the last 5 years.

Calculate monthly tax deduction 2022 for Malaysia Tax Residents. Search for jobs related to Malaysia salary calculation formula or hire on the worlds largest freelancing marketplace with 20m jobs. Daily ratemonthly salary 26 rm 1800 26 rm 6923.

RM 6000 RM 2500 RM 8500. The gross salary and statutory deductions are then used to calculate the final Net Pay. Working period of more than 5 years 20 days of salary per year.

This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates. You can edit the preset OT rates and also create new OT rates by clicking on Add Custom Rate. Payment for termination notice.

An employee weekly rate of pay is 6. In the case of employees receiving wagessalaries of RM5000 and lower the share of the employees contribution is 11 percent of their monthly pay with the employer contributing the remaining 13 percent of their monthly salary. To manually calculate unpaid leave you should ensure that Record Unpaid Leave in Payroll is not ticked under Settings Payment Settings.

To calculate the daily rate you can divide the monthly salary by either of. How to calculate your salary per day malaysia. EPF Employer Contribution.

Employer Employee Sub-Total - EPF Contribution. Employed for more than five years obtains twenty days of salary. Taxable Income MYR Tax Rate.

The Monthly Wage Calculator is updated with the latest income tax rates in Malaysia for 2022 and is a great calculator for working out your income tax and salary after tax based on a Monthly income. RM 5500x 12 calculation by percentage. How is EPF calculated in Malaysia.

Fixed Number of Days. RM 8500 x 12 refer Third Schedule. Monthly Salary Number of days employed in the month Number of days in the respective month Overtime rate.

For resident taxpayers the personal income tax system in Malaysia is a progressive tax system. For 2022 tax year. How to Perform Salary Calculator Malaysia.

An employee monthly rate of pay is always fixed to 26. Basic Allowance Incentive 26 days 8 hours. Working days in Current Calendar Month including public holidays All Days in Current Calendar Month.

Paying employee wages late. Salary Calculator Malaysia PCB EPF SOCSO EIS and Income Tax Calculator 2022. Salaries in malaysia range from 1670 myr per month minimum salary to 29400 myr per month maximum average salary actual maximum is higher.

According to the Employment Act 1955 employers are required to payout monthly wages on the seventh day of the following month or earlier. The calculator is designed to be used online with mobile desktop and tablet devices. Malaysia Monthly Salary After Tax Calculator 2022.

PCB calculator Tax calculator EPF Payroll.

Gross Income Formula Step By Step Calculations

How To Create A Monthly Salary Sheet Format In Excel With Easy Steps

Payroll Malaysia Calculation Of Salary For Incomplete Month Youtube

Salary Calculation Dna Hr Capital Sdn Bhd

How To Calculate Income Tax In Excel

Download Teacher Salary Slip Excel Format

Purchasing Power Parity Formula Calculation Examples

Salary Formula Calculate Salary Calculator Excel Template

Excel Formula Basic Overtime Calculation Formula

Salary Formula Calculate Salary Calculator Excel Template

How To Calculate Income Tax In Excel

Gross Income Formula Step By Step Calculations

How To Calculate Income Tax In Excel

Salary Formula Calculate Salary Calculator Excel Template

Overtime Calculation Formula In Excel Youtube

How To Calculate Income Tax In Excel

Excel Formula Timesheet Overtime Calculation Formula Exceljet

What Is Basic Salary Definition Formula Income Tax Exceldatapro

Salary Formula Calculate Salary Calculator Excel Template